Korea and its economy – Facts & figures

Country name: Republic of Korea (South Korea)

Capital city: Seoul (since 1394)

Language: Korean (Written form: Hangeul)

Other information

Geographical location: The Korean Peninsula (lat. 33˚ ~ 43˚; long. 124˚ ~ 132˚)

Territory:

223,433 km2 (including North Korea)

- South Korea only: 100,295 km2 (2015)

Standard time: 9 hours ahead of Greenwich Mean Time

Population: 51.07 million (South Korea, 2016)

Major cities by population (2015): Seoul (9.744 million), Busan (3.216 million), Incheon (2.685 million), Daegu (2.244 million), Daejeon (1.564 million), Gwangju (1.536 million)

Political system: Free democracy; Presidential system

President: Moon Jae-in (since 2017)

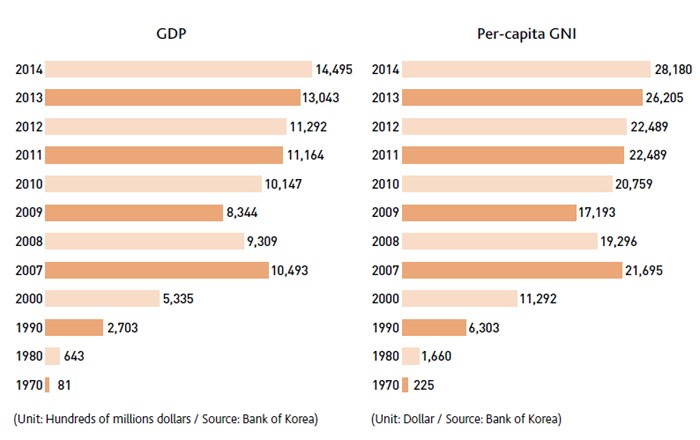

Economy indicator

GDP: US$1,411 billion (2016)

Per capita GNI: US$27,561 (2016)

GDP growth rate: 2.8% (2016)

Currency: Korean won (US$1 = 1,208 won; floating exchange rate)

Trade:

Export: US$552.3 billion (2017 est.)

Imports: US$448.4 billion

(2017 est.)

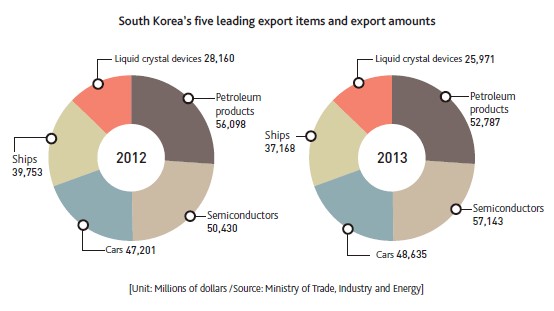

Major industrial products:

Semiconductors, automobiles, ships, petroleum products, liquid crystal devices

Railways industry in Korea

Railways infrastructure in Korea

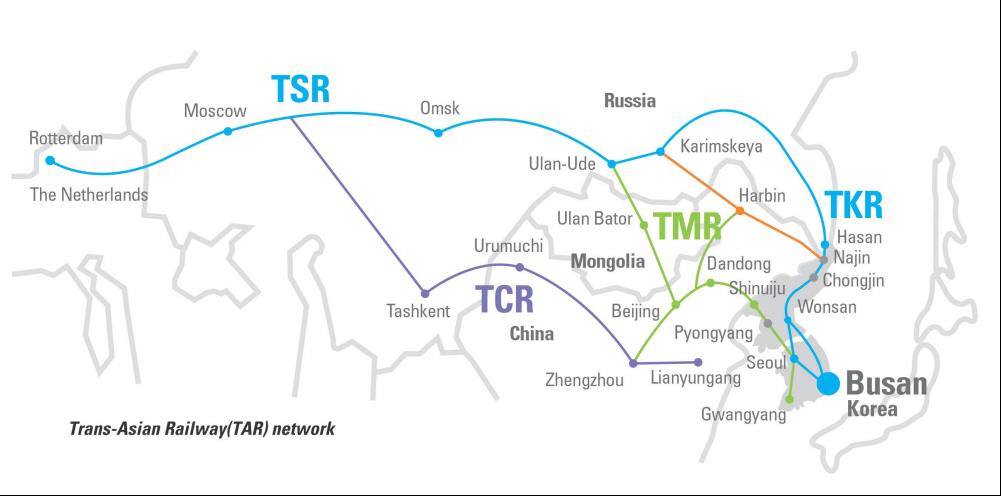

Business Background: Trans-Asian Railway Network

South Korea is eager to be reconnected to the Trans-Korean Railways (TKR) and the emerging Trans-Asian Railway (TAR) network – the Iron Silk Road that connects Asia and Europe.

Establishing the railroad that runs across the Korean peninsula has been a long-cherished desire of South Korean political leaders in a bid to crack open North Korea, but it has been shelved whenever the tensions between two Koreas grew. But the idea of restoring the disconnected cross-border traffic route came back, buoyed by the inter-Korean summit in April 2018. After the historic inter-Korean summit concluded on a high note, hopes are growing that North Korea may soon re-open its doors to South Korea, and connecting railways is the precursor for broader economic cooperation.

Trans-Asian Railway (TAR) network

With the two Koreas’ leaders pledging to restore now-defunct railways and roads during the summit, hopes are high that the initiative will prompt cross-border cooperation in the economy and logistics. President Moon Jae-in and North Korea’s leader Kim Jong-un agreed to adopt “practical measures” to connect and modernize the Gyeongui Line and East Coast Line. The former is between Seoul and Sinuiju, while the latter had connected the South’s coastal city of Busan and Wonsan of the North.

In preparation for the possible reunification of the divided peninsula, South Korea has gradually rebuilt and upgraded the southern section of disconnected railways and road. The government is seeking to invest more in the nation's rail transport sector over the next three years. It plans to build a railroad logistics hub in the Seoul metropolitan area and to expand a railroad line on the east coast and south of the inter-Korean border.

The reconnection of trans-Korean railway suggests us significant meanings as an important inter-Korean economic cooperation as well as a cornerstone for the TAR network. The TAR network, cutting across the entire Asian continent, offers a land transport alternative, which links Asian markets with Europe and facilitates intra-regional and inter-regional movements.

Inter-Korean summit at Panmunjeom in April 2018

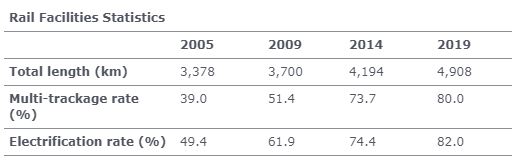

Rail facilities statistics

Korea depends heavily on road transport for movement of people and goods but is making efforts to make a change to railroad transport which is considered much safer and more environmentally sustainable.

The government increased the investment in railway infrastructure in accordance with the mid and long-term 'National Inter-modal Transportation Plan’ (2000-2019), which earmarks 94 trillion won for railways, and the government plans to extend the length of railroads to 4,908km by 2019 with 80 percent of the lines multi-tracked and 82 percent electrified.

Railway and rolling stock technology

Meeting the “Green Growth Era,” Korea’s railway industry which has been sluggish for decades is now gaining a new vigor. The opening of the first phase of the Gyeongbu (Seoul-Busan) High-Speed Railway has greatly contributed to putting much of the nation within half a day’s travel as well as helping to balance the national transport system, which had relied heavily on automobiles. The Korea Train Express (KTX) has the design speed of 330km/h and a maximum service speed of 300km/h. With the completion of the 167.2-kilometer Daegu-Busan section of the second phase of Gyeongbu line, followed by the 230.3-kilometer Osong-Mokpo section of the Honam line, the construction of which was completed in 2017 – KTX came to connect more of the nation, helping solidify national competitiveness and social cohesion. The nation is also developing high-speed electric tilting trains and next-generation light trains based on new materials for operation in areas where KTX cannot run.

High-speed rail

The Korea Train Express, or KTX, went into operation in April 2004. The first phase – covering a 293.1 kilometer route between Seoul and the southeastern city of Daegu – was completed 12 years after construction began in June 1992. The KTX cut travel time by between 33 and 46 percent – it takes 1 hour and 39 minutes to Daegu, and 2 hours and 40 minutes to Busan. The primary purpose of the new “bullet train” system was to augment the shipping capacity of the Gyeongbu corridor and address the traffic congestion stemming from the concentration of population and industry.

Construction of the second phase of the Gyeongbu Line, linking southeastern cities of Daegu, Gyeongju, Ulsan and Busan, started in 2002. When it is complete in 2010, the high-speed track will extend to 418.7 kilometers and the travel time between Seoul and Busan will be reduced to 2 hours and 10 minutes.

Construction of another high-speed network will begin shortly. The 231.2-kilometer Honam Line will branch from the Gyeongbu Line in the central town of Osong and stretch southwest to Iksan, Gwangju and Mokpo. The new line will contribute to improved traffic conditions and regional development in South and North Jeolla provinces. The Osong-Gwangju section is scheduled to be completed by 2014 and the remainder by 2017. The travel time between Seoul and Mokpo (352.7 kilometers) will be cut to 1 hour and 46 minutes from the current 2 hours and 38 minutes.

Significantly, the first set of the new Korean high speed train, KTX-II was revealed to the public in 2008, making Korea the fourth nation in the world to manufacture and operate 300km/h high-speed trains following France, Germany and Japan.

Designed for a maximum speed of 330km/h, KTX-II trains have a 10-car formation which can be used singly or in pairs, unlike the French-designed, fixed 20-car KTX sets used on the Gyeongbu line. According to Hyundai Rotem, the proportion of Korean content in the KTX-II sets is 87%, compared with 58% for the locally-assembled KTX trains. According to The Korea Transport Institute, the high speed train development program is expected to generate benefits worth 7.5 trillion won and reduce the Korean railway budget by 840 billion won by 2020.

In this era of green growth, high-speed rail will get more attention, and therefore needs to be developed continuously. Beginning 2007, the next-generation power-decentralized type 400km/h high speed train (HEMU-400X) has been under development, which will lead the era of green growth by incorporating home-grown information technology and green technology.

By 2017, it is expected that the entire nation will be merged into one economic bloc, in which most places are reachable within two hours’ travel. In the near future, Korea will see the entire nation linked by high-speed rail and evolve into a mega-city region which refers to a wide economic zone with a population of over 10 million, formed around a core city and functionally linked together, in which all areas can be reached within one day.

Tilting train

The locally developed tilting train, named “Hanbit 200,” successfully ran a test ride in October 2008 and conducted reliability test in January 2010.

A tilting train utilizes a mechanism that enables rolling to better negotiate the curved parts of regular railroad tracks. The new train tilts up to eight degrees inward, in the same way as a short-tract skater leans into a bend, allowing it to run 20–30% faster on curved tracks than the normal trains must reduce speeds at bends to keep them from derailing. The tilting train achieved a maximum speed of 200km/h and 100km/h at track curves.

The new train is eco-friendly and cost effective because it uses existing track, reducing the need for additional construction. The cars used in the homegrown tilting train system are made of carbon fiber reinforced materials that makes the train 40 percent lighter than a train made of aluminum.

The Korea Railroad Research Institute (KRRI) has been developing the tilting train system since 2001, investing 40 billion won (US$29.6 million) for the last six years to develop high-speed train. It plans to put the new system into commercial use by 2012.

Light rail transit

KRRI developed the rubber-tired AGT, named K-AGT (Korean Automated Guideway Transit) between 1999 and 2005, making Korea the fourth nation in the world to develop and operate the AGT system. K-AGT is a light rail transit system that does not require a driver and generally operates on an elevated railroad for transporting passengers.

K-AGT features fully automatic operation to minimize the labor costs, and the light-weight, smaller vehicle lowers construction costs as well as electricity costs. The rubber-tired K-AGT produces less noise and vibration; with single-axle bogie, there is no friction noise in curves while keeping high speed.

The rubber-tired AGT are applied to 50 lines in 14 countries worldwide, providing 85% fully automated operation. In Korea, 10 out of 17 lines will be rubber-tired vehicles, and 4 out of 13 steel-wheel vehicle lines are scheduled to be retrofitted with rubber tires.

Seoul Metro, which operates Seoul subway lines 1 through 4, will also run a light railway system connecting Busan and Gimhae. The Busan-Gimhae Light Rail Transit (BGL) will operate two-carriage unmanned light trains on the 23.9km-long line with 21 stations. Construction began in 2006 and it will start operation in April 2011. Based on 35 years of experience and knowhow, Seoul Metro is promoting overseas expansion as well: it signed an MOU with Thailand to build subway lines in Bangkok in 2007 and another with Vietnam to construct a fifth subway line in Hanoi in 2008.

Magnetic levitation train

Korea will operate unmanned magnetic levitation trains, or maglev trains on Yeongjong Island from 2013, becoming the latest country after Japan to commercialize the next generation transportation system. The maglev trains will connect Incheon International Airport and Yongyoo Station where travelers can take express trains heading to Seoul. According to the Ministry of Land, Transport and Maritime Affairs, the construction of 6.1km railway started in August 2010, which is expected to be completed by 2012 within the country’s main airport and begin running unmanned magnetic levitation trains that will travel at 110km/h.

As one of Korea’s state-funded R&D projects, the government decided in 2006 to invest 450 billion won (approx. $385 million) into developing the magnetic trains and railway tracks by 2012. All the technologies have been developed by local entities, including the Korea Institute of Machinery and Materials and Hyundai Rotem.

Maglev trains, which are suspended in the air above specially designed tracks, are propelled by a linear motor that uses the repulsive and attractive forces of magnetism. Because there is no physical contact between the vehicle and the track, the maglev system has many advantages – it can travel at very high speeds with reasonable energy consumption and at low noise levels.

The highest recorded speed of a Maglev train is 581km/h (361mph), achieved in Japan in 2003, 6km/h (3.7mph) faster than the conventional TGV speed record. The most well known implementation of high-speed maglev technology currently operating commercially is the IOS (initial operating segment) demonstration line of the German-built Transrapid train in Shanghai, China that transports people 30km (18.6 miles) to the airport in just 7 minutes 20 seconds, achieving a top speed of 431km/h (268mph), averaging 250km/h (160mph).

Transportation and logistics infrastructure

Government policy

Korea has made an extensive investment in expanding and modernizing its transport infrastructure since the 1960s, aiming not only to ease traffic congestion, but also to enhance growth potential and improve quality of life.

From 2005 to 2009, despite relative increases in government transport infrastructure investment has gained 7.8 percent on average, on a par with the 7.9 percent expansion of the overall national budget. Infrastructure investment accounted for 7.7-8.7 percent of total public expenditure during the same period, attesting its importance for national growth and advancement. In 2009, the government raised its spending on transport infrastructure to assist regional development by a whopping 26 percent, far higher than the average growth rate of 3 percent during 2004-8. With continued increases in infrastructure investment, the nation could expand its transportation stock, complete the frame of a nationwide transport network and sharply increase transport capacity for both passengers and freight.

The government is speeding up the development of main facilities, adjoining areas and access transportation facilities at Incheon Airport and Busan and Gwangyang Ports in order to turn them into logistics centers in Northeast Asia according to the roadmap. The nation is also expanding inland logistics hubs/terminals for more efficient transportation network, while adjusting the allocation of transportation facility investments to increase investments in railways and seaports in order to build large capacity transportation network.

Furthermore, customs clearance procedures are being greatly facilitated and Customs Free Zone and Free Trade Zone Acts, which aim to assist international logistics activities, are being integrated to promote attraction of world’s top logistics companies to Korea. In addition, the government is very active in promoting logistics companies and training experts who will play leading roles in the improvement of Northeast Asia’s logistics system.

In transport infrastructure policies, the nation set its sights on the enhancement of national competitiveness by lowering logistics costs. It also aims to improve of quality of life through higher mobility, better accessibility and greener transportation.

World-class logistics hub

On August 2003, the government conceived the vision of developing Incheon International Airport, Busan Port and Gwangyang Port into a “Gateway to Northeast Asia, a gathering place for people, information and cargo from around the world” and integrated the related plans of individual government agencies to establish a comprehensive “Northeast Asian Logistics Hub Roadmap.”

As for air transportation, Incheon International Airport serves as the nation’s hub for external connection. Incheon International Airport, opened in March 2001, is equipped with state-of-the-art facilities and provides advanced traffic networks for its customers. With its strategic location, the new airport is poised to become a leading logistics and transportation hub in Northeast Asia. Expansion plans for the airport area include establishing a Free Trade Zone, International Business District and Special Economic Zone.

Songdo International Business District (IBD) is a master-planned international business center being developed on 1,500 acres of reclaimed land along Incheon’s waterfront. It is located 40 miles south of Seoul and will be connected to Incheon International Airport by a 7-mile highway bridge.

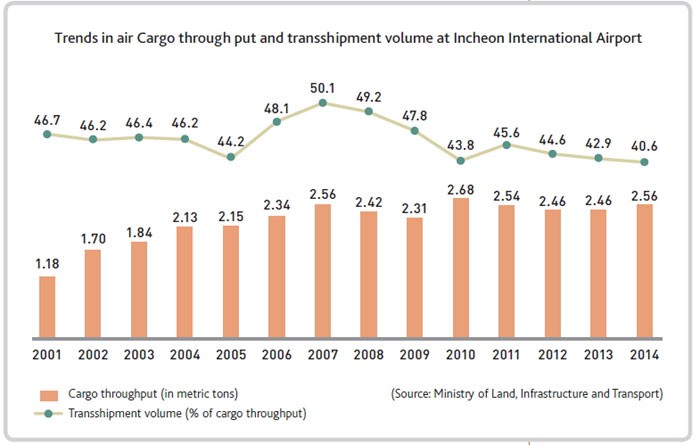

Incheon International Airport has seen a continuous increase in the volume of cargo since its opening in March 2001. In 2006, it handled 2.34 million tons of international air cargo, becoming the second leading airport in the world in terms of air cargo volume.

To accommodate an ever-growing flight demand, the airport is set to expand its passenger and cargo terminals and concourse in steps. The scope and timing of a third phase of expansion will depend on future travel demand.

Seaports are another pillar of transportation in Korea. With the completion of Busan New Port and the expansion of Gwanyang Port, the nation achieved its long-anticipated “Two-Port System,” adding momentum for the nation’s ambition to become a Northeast Asian Logistics Hub. Logistics infrastructure at Busan Port and Gwangyang Port will be developed to allow them to increase their significances as freight hubs and become key maritime bases in Northeast Asia.

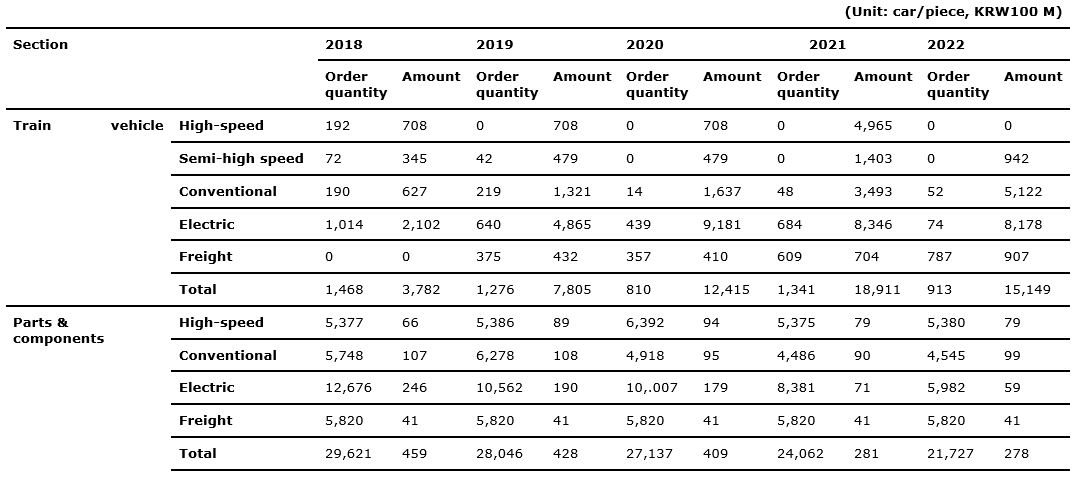

Cargo volume and trans-shipment rate at Incheon International Airport (Unit: million tons) Source: Incheon Internatinal Airport Corporation (IIAC)

Container ships from Korea ply international sea lanes to ports in South and North America, Europe, Australia, the Middle East and Africa. Foreign ocean liners, cruise ships and passenger-carrying freighters also pay frequent visits to Korean ports.

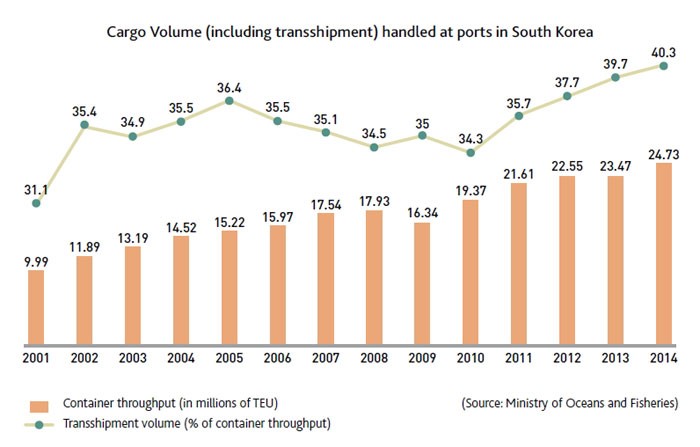

Port cargo volume also climbed steadily, from 11.89 million twenty-foot equivalent units (TEU) in 2002 to 17.48 million TEU in 2007, with the expansion of port facilities and increased productivity through improved cargo handling capabilities at Busan New Port, Gwangyang Port and Incheon Port. In particular, Busan Port handled 12.04 million TEU in 2006, ranking fifth in the world for three consecutive years in terms of volume of containers handled.

In addition, with the aim of increasing the annual cargo handling capacity at seaports from the current 423 million tons to 1.01 billion tons by 2019, the government plans to put port bases in operation in each of six mega-regional economic zones, including the greater Seoul zone, develop more logistics complexes in port hinterlands, and build Saemangeum New Port as part of the development plan for the Saemangeum area of reclaimed land. The master plan also looks to construct a nationwide logistics network by expanding and refurbishing large-scale inland freight docks in five regional economic zones. The government will consider constructing two or three more such facilities depending on future demand.

Port cargo volume and transportation rate (Unit: million tons) Source: Ministry of Land, Transport and Maritime Affairs